Quarterly 941 For 2024

Quarterly 941 For 2024. I understand the importance of having the correct pay and due period in your quarterly 941. Since you're experiencing the same issue after performing the steps.

You must file form 941. Here are the due dates for each quarter:

You’ll Report Withholding Amounts For Federal Income Taxes And.

The form 941 will be automatically updated in quickbooks through payroll tax table updates.

You Must File Form 941.

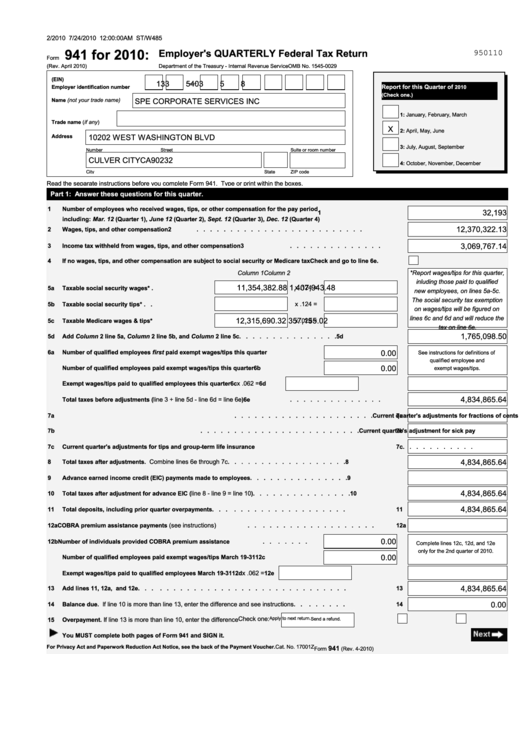

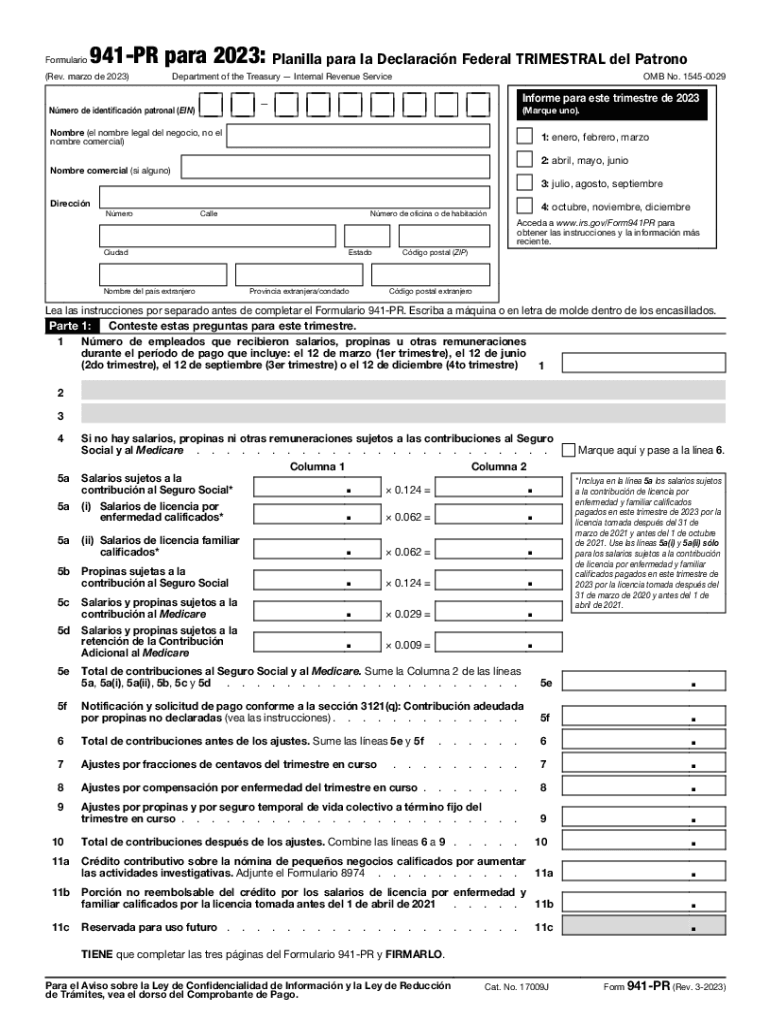

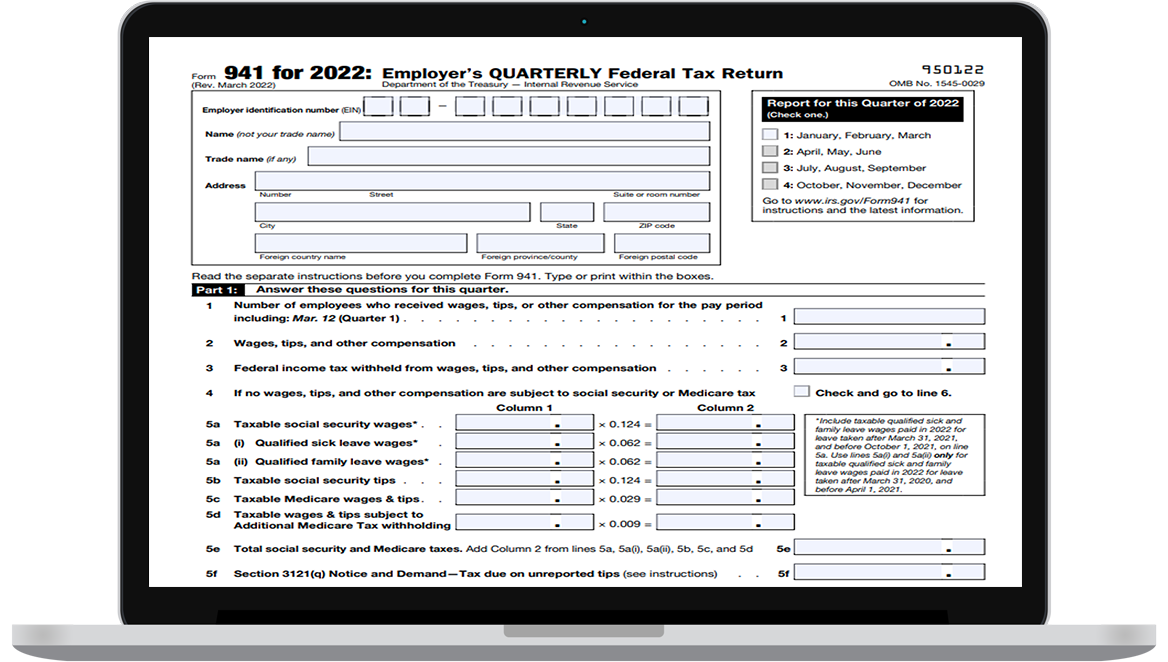

The irs form 941, employer’s quarterly federal tax return, used by businesses to report information about taxes withheld such as federal income, fica.

Quarterly 941 For 2024 Images References :

Source: codeeqloraine.pages.dev

Source: codeeqloraine.pages.dev

941 For 2024 Employers Quarterly Andra Blanche, Since you're experiencing the same issue after performing the steps. The revised schedule b for form 941 in 2024 streamlines the reporting process for businesses, aligning it with other tax forms.

Source: kathqminette.pages.dev

Source: kathqminette.pages.dev

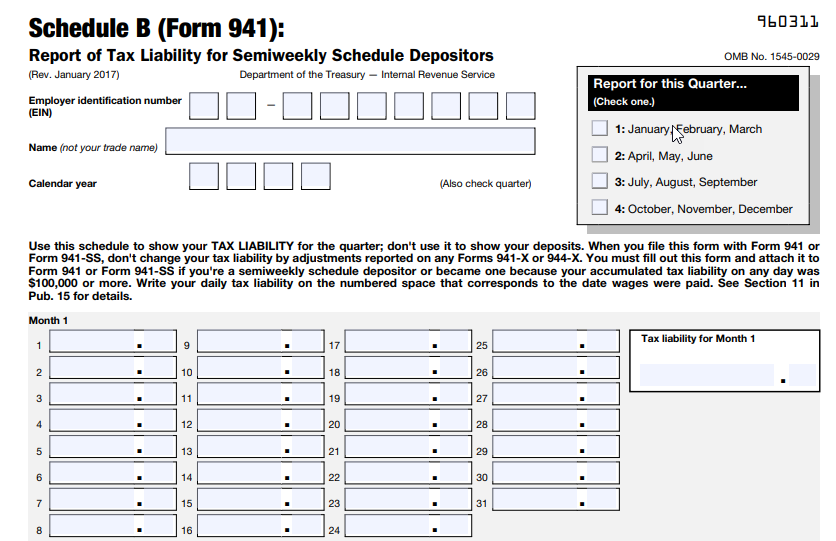

Schedule B Form 941 For 2024 Beulah Evangelina, File form 941, “employer’s quarterly federal tax return,”. Form 941 reports federal income and fica taxes each quarter.

Source: www.fileform941.com

Source: www.fileform941.com

File Form 941 Online for 2024 How to Efile 941, (nasdaq:mu) q3 2024 earnings call transcript june 26, 2024 micron technology, inc. The internal revenue service (irs) has recently released the 2024 form 941, employer’s quarterly federal tax return, along with schedule b, report of tax.

Source: www.file941online.com

Source: www.file941online.com

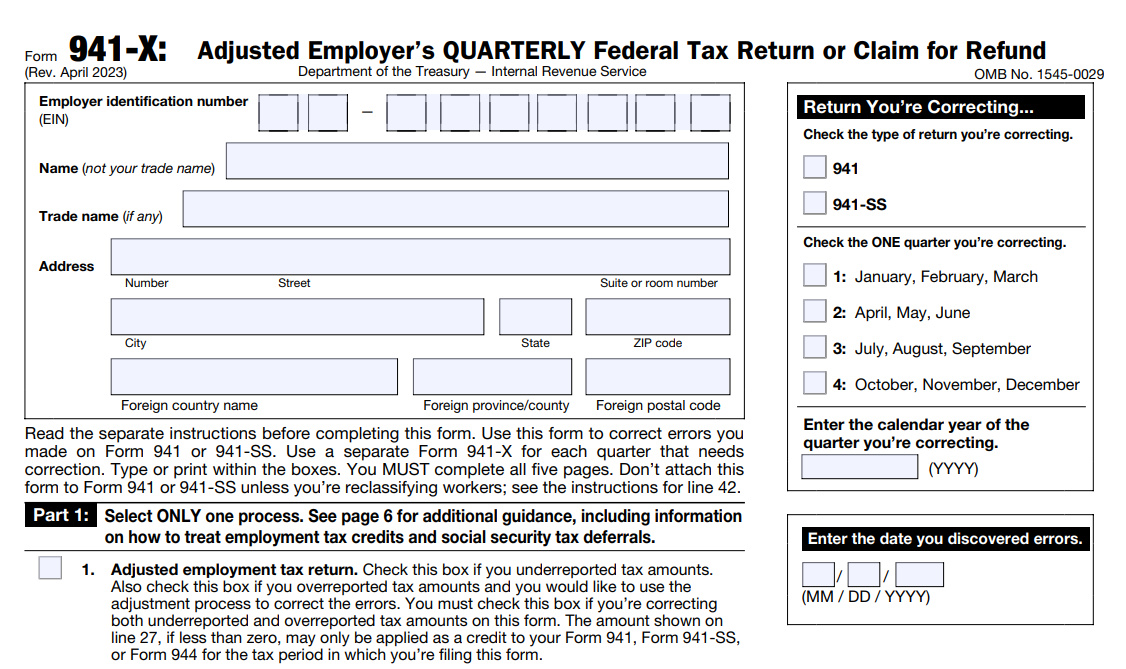

File 941 Online How to EFile 941 Form for 2024, I appreciate you for getting back and providing more details to your post, @okie129. For the 2024 tax year, the form 941 filing deadlines remain critical for employers to adhere to, ensuring timely.

Source: codeeqloraine.pages.dev

Source: codeeqloraine.pages.dev

941 For 2024 Employers Quarterly Andra Blanche, Multibagger stock inches close to lifetime high as baord sets date to consider quarterly results. You must file form 941.

Source: www.vrogue.co

Source: www.vrogue.co

Printable 941 Quarterly Form Printable Form 2024 vrogue.co, Employers must file on time to avoid penalties. Form 941 reports federal income and fica taxes each quarter.

Source: walliszcati.pages.dev

Source: walliszcati.pages.dev

941 Form 2024 Schedule B Raf Leilah, When are the form 941 deadlines for the 2024 tax year? Irs form 941, also known as the employer's quarterly federal tax return, is used when businesses report the income taxes, payroll taxes, social security, and medicare taxes withheld from their.

Source: www.signnow.com

Source: www.signnow.com

941 for 20232024 Form Fill Out and Sign Printable PDF Template, Quarterly federal tax form 941 for the third quarter ending september 30, 2024. You must file form 941.

Source: lisaqchristie.pages.dev

Source: lisaqchristie.pages.dev

941 Form 2024 Pdf Mufi Tabina, Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. The form 941 will be automatically updated in quickbooks through payroll tax table updates.

Source: fincent.com

Source: fincent.com

Guide to IRS Form 941 Quarterly Federal Tax Return, Provision for credit losses is seen at the higher end of. Quarterly returns for q4 payroll and income taxes from the prior year (form 941) or annual.

Form 941 Reports Federal Income And Fica Taxes Each Quarter.

Employers must file irs form 941, employer's quarterly federal tax return, to report the federal income taxes withheld from employees, and employers' part of social security.

Quarterly 941 Due Dates 2024 Seana Courtney, The Deadline To File Form 941 For The Second Quarter Is July 31, 2024.

Multibagger stock inches close to lifetime high as baord sets date to consider quarterly results.

Category: 2024